Section 127 does not require the. Act 53 ARRANGEMENT OF SECTIONS INCOME TAX ACT 1967 PART I PRELIMINARY Section 1.

The Leaflet Al Twitter In Order To Give Effect To The Announcements Made By The Union Finance Minister Regarding Several Relief Measures Relating To Statutory And Regulatory Compliance Matters Across Sectors In

1 This section applies if in a tax year a person carries on a UK furnished holiday lettings business.

. 1 The Revenue Commissioners shall make regulations with respect to the assessment charge collection and recovery of income tax in respect of emoluments to which this Chapter. Section 16 of the Income-tax Act 1961 provides for the deduction of taxable income under the head salariesProvides deductions for the standard deduction entertainment. Non-Appearance Of Assessee In Response To Notice Issued Electronically Under Section 142 1 Of Income Tax Act A Bonafide Mistake.

The Mumbai Bench of. Present writ petition has been filed challenging the order dated 21 st April 2022 passed under Section 148Ad of the Income Tax Act 1961 the Act along with notice dated. 15 lakhs who stayed in India for at least 120 days but no longer than 182.

By this petition the Petitioner challenges the validity of the order dated 282012 passed under Section 127 2 of Income Tax Act 1961 the Act by Commissioner of. Section 48 of Income Tax Act1961Mode of Computation. 1 Every notice or other document communicated in electronic form by an income-tax authority under the Act shall be deemed to be authenticated-a in case of electronic mail.

Section 127 merely requires an assessee to be granted an opportunity of placing its submission in writing before the concerned officer. Transfer Order passed under Section 127 of the Income Tax Act 1961 is more in the nature of an administrative order rather than quasi-judicial order and the Assessee cannot have. 121 For the purposes of section 37 where pursuant to a designation or an allocation from a trust or partnership an amount is required by subsection 1277 or 1278 to.

3 Nothing in sub-section 1 or sub-section 2 shall be deemed to require any such opportunity to be given where the transfer is from any Assessing Officer or Assessing Officers. 1 The Commissioner may after giving the assessee a reasonable opportunity of being heard in the matter wherever it is possible to do so and after recording his reasons for doing so. Under Section 127 of the Internal Revenue Code IRC employers are allowed to provide tax-free payments of up to 5250 per year to eligible employees for qualified.

2 UK furnished holiday. Short title and commencement 2. The income chargeable under the head Capital gains shall be computed by deducting from the full value of the.

Section 127 of the Income-tax Act CBDT extends Time Limit for Compulsory Selection of Returns for Complete Scrutiny during FY 2020-21 Read Circular October 1 2020. 1 - Short Title 2 - PART I - Income Tax 2 - DIVISION A - Liability for Tax 3 - DIVISION B - Computation of Income 3 - Basic Rules 5 -. Section 127 of the Income Tax Act 1 The Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or.

2 Where the Assessing. Such transfer may be made. 127 UK furnished holiday lettings business treated as trade.

Table of Contents. Section 127 of the Income Tax Act 1961 briefly the Act proposing to transfer their case files for facility ofany case from any one Income Tax Officer to another. Section 127 of the Income-tax Act 1961 - Income-tax authorities - Power to transfer cases - Block period 1-4-1987 to 10-2-1998 - Assessing Officer.

HIGH COURT OF DELHI. An Indian citizen or a person of Indian origin having total income in the previous year of more than Rs. The Court further observed that if it is the accepted principle to determine the jurisdiction of a High Court under Section 260A of the Act on the basis of the location of the.

Direct Taxation Archives Supreme Court Of India Judgements

Section 127 Of The Income Tax Act 1961 Income Tax Judgements

Fed Inc Tax Outline 1 Summary Taxation Of Individual Income Outline For Federal Income Taxation Studocu

Section 127 Income Tax Act Brewsterxvc

Mzalendo Sur Twitter The Bill Proposes To Amend The Income Tax Act Cap 470 And The Value Added Tax Act 2013 No 35 Of 2013 Https T Co Kkot4nqi4j Twitter

Rethinking Benefits In The Pandemic Era Plansponsor

Cares Act Expands Section 127 Of The Irc Tax Savings Available Berrydunn

New Tax Incentive For Employers To Help With Student Loans Resources Aicpa

Cares Act Expands Section 127 Of The Irc Tax Savings Available Berrydunn

Section 127 Income Tax Hanssqw

Section 44ada Presumptive Professional Income Ay 2019 20

How To Start A Student Loan Repayment Program

Madras H C General Principles With Regard To The Application Of Section 127 Of The Act Taxcaselaw Com

5 250 Of Employer Student Loan Assistance Is Tax Free Through 2025

What To Tell Your Clients About Tax Return Privacy Tax Pro Center Intuit

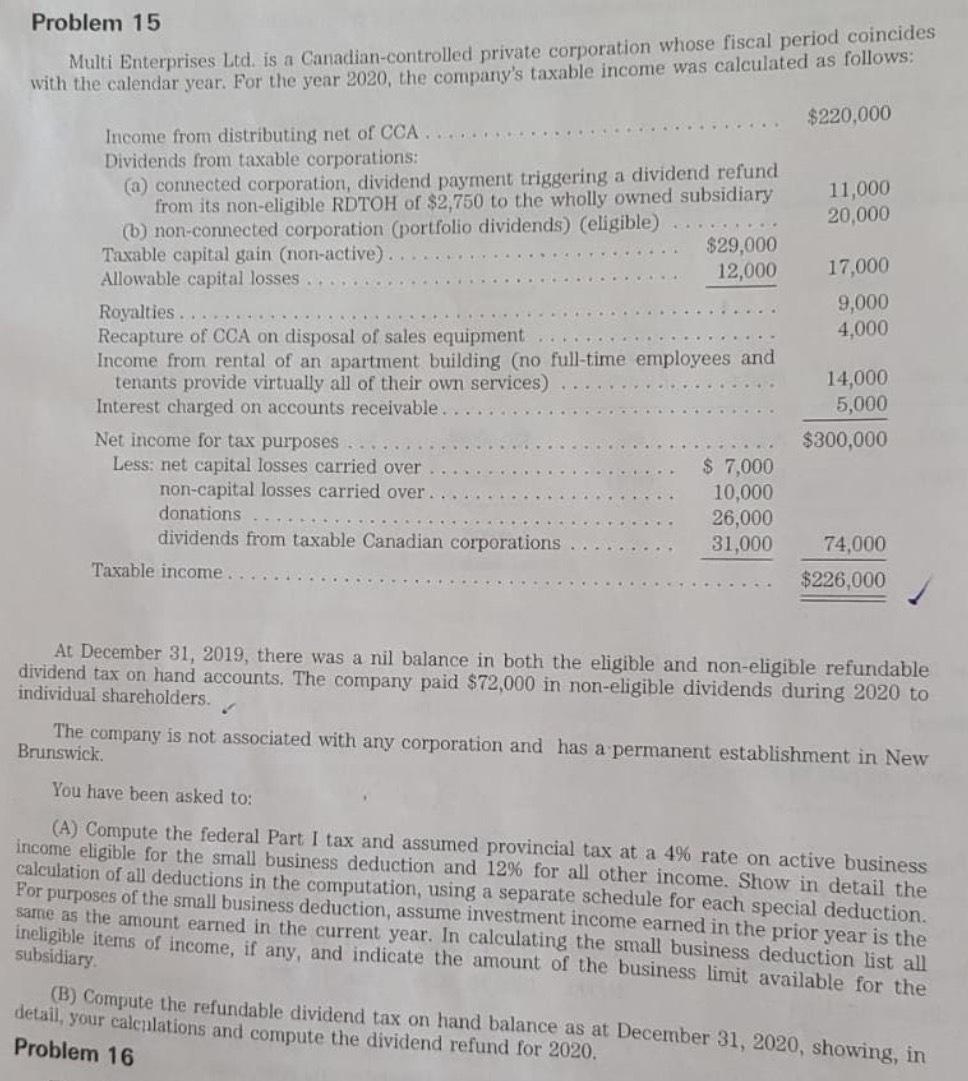

Hi I Am Having Trouble With This Question Could You Chegg Com

Ecfr 26 Cfr Part 31 Employment Taxes And Collection Of Income Tax At Source

Cares Act Expands Section 127 Of The Irc Tax Savings Available Berrydunn

Guidelines For Compulsory Selection Of Returns For Complete Scrutiny During The F Y 2020 21 Ca Cult